Cycle To Work Schemes

Shop with us using your Cycle to Work voucher and save up to 49%!

What are Cycle to Work Schemes?

Cycle to Work schemes are designed to save you money on a new bike or e-bike.

They spread the cost over monthly tax-free instalments taken directly from your salary, saving you from 25% up to 49% depending on salary.

Why use Cycle to Work Schemes?

They are government schemes to help people switch to eco-friendly transport, and there's some great benefits for you:

✅ Cycling to work is great for your physical and mental health

✅ Helps you to reach your fitness goals

✅ They save you time, combining commuting with exercise

✅ Reduces your carbon footprint, and pollution

✅ An e-bike will help you arrive more refreshed

✅ You'll save money from fuel, parking, bus, or train fares

✅ Instalments are simply collected through your salary, pre tax

How do I get started?

It can seem confusing at first, but don't worry, we can guide you through the process and get you on the road soon. Just follow our 3 simple steps below:

Select your scheme

Find out which Cycle to Work scheme your employer is signed up to, or ask them to sign up.

Ensure that your salary after deductions will stay above the National Minimum or Living Wage.

Note: We are actively signing with schemes, currently live with:

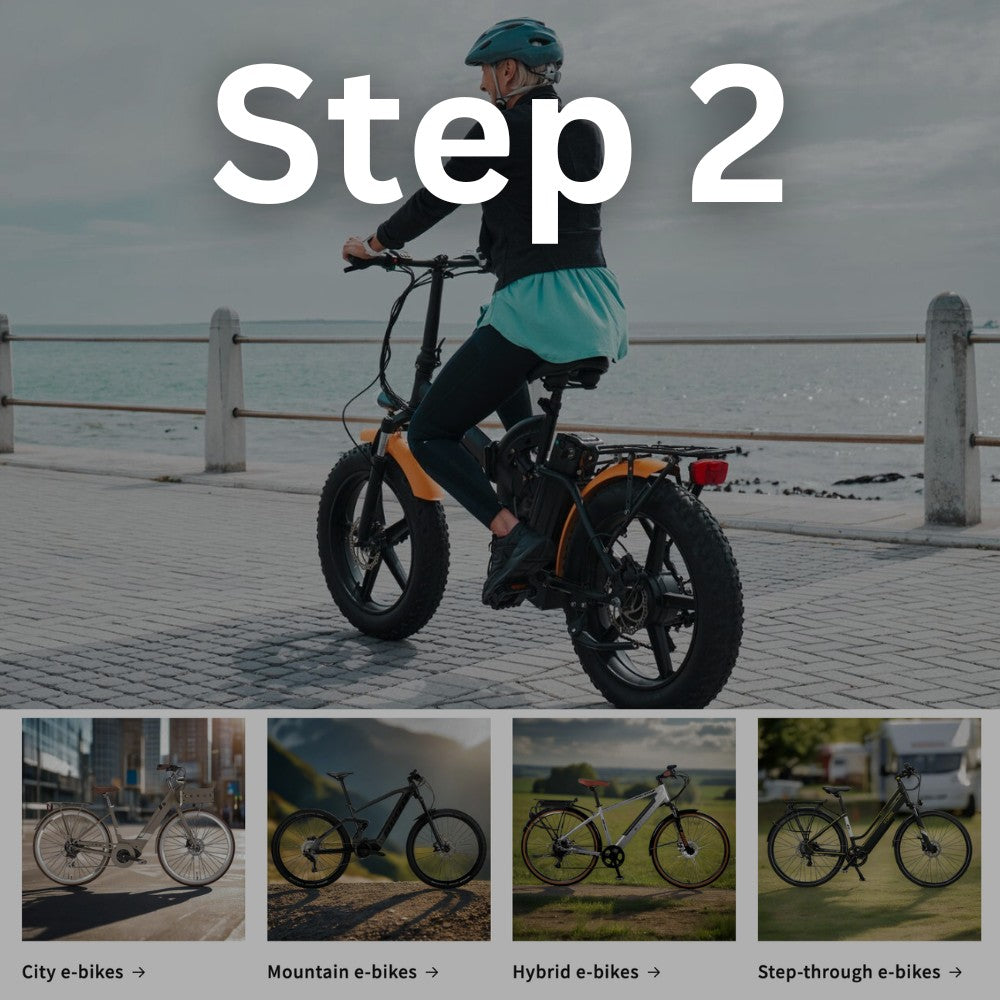

Choose your e-bike

Browse our store to pick your perfect new e-bike (we can help you choose), making a note of any options and accessories, and let us know in the form below so we can confirm the final price.

Any 250W / 15.5mph assist e-bike that conforms to the EAPC specification is eligible.

Use your voucher

We will help you request your voucher for the total amount, and when you get your voucher (collection letter) just send to us and we will dispatch your new e-bike.

Then enjoy your new ride!

Cycle To Work

Further Information

🚴 Cycle to Work is open to all employees paid through the PAYE system. It is not available to self-employed workers or employees on the National Minimum Wage, as salary sacrifice cannot reduce their earnings below the minimum wage threshold.

🚴 You can purchase bicycles, including e-bikes that comply with EAPC rules, and a range of safety equipment such as helmets, lights, locks, and reflective clothing. The scheme covers any cycle that helps you commute, including non-standard cycles like tricycles and adapted cycles for disabilities.

🚴 As for other stores, the Cycle to Work scheme usually only applies to pre-discounted prices. Discount vouchers cannot be used in conjunction with Cycle to Work.

🚴 While the bike should primarily be used for commuting, you can also use it for personal activities.

🚴 You'll need to send proof of identity, such as driving licence, or a utility bill along with your voucher / collection letter.

🚴 At the end of the hire period, you can usually choose to return the bike, buy it at a fair market value, or extend the hire period often at no cost. Most providers offer the option to buy the bike at a significantly reduced price after the initial hire period, so check with your scheme.

🚴 It is recommended to insure your bike against theft or damage, as you will be liable for repayments even if the bike is stolen or written off during the hire period. See our links to Laka for innovative e-bike insurance.

Find your perfect Cycle to Work e-bike below

-

City e-bikes

Perfect for getting about in and around a city or town, our...

-

Folding e-bikes

Small and compact, these folding bikes are perfect for commuting, taking on...

-

Hybrid e-bikes

Great for road and casual off-road our hydrid e-bikes have wider tyres...

-

Mountain e-bikes

Explore the great outdoors over the toughest terrain with an electric mountain...